Accept Payments Online and Get Paid 2x Faster

FreshBooks Payments make it easier for your clients to pay online, which means you get paid twice as fast. What better way is there to improve your cash flow?

Online Payments Seamlessly Link With FreshBooks

FreshBooks Payments lets your customers pay directly through invoices and automatically records each payment in your account. It’s fast, easy, secure and perfectly integrated.

No setup, monthly or hidden fees:

2.9% + $0.30 per transaction on most cards

- Secure for you and your clients

- Accept all major credit cards

- No hidden fees

![]()

Competitive pricing with no hidden fees:

2.9% + $0.30 per transaction

- Trusted by millions of users around the world

- Accept Visa, Mastercard and American Express

- Accept Venmo and PayPal Credit

- Take payments in 25 currencies from 202 countries

More Payment Options and No Hidden Fees

Giving your clients more ways to pay gets you paid faster. And, you’ll always know exactly how much money you’re taking in because Stripe and PayPal pricing is transparent.

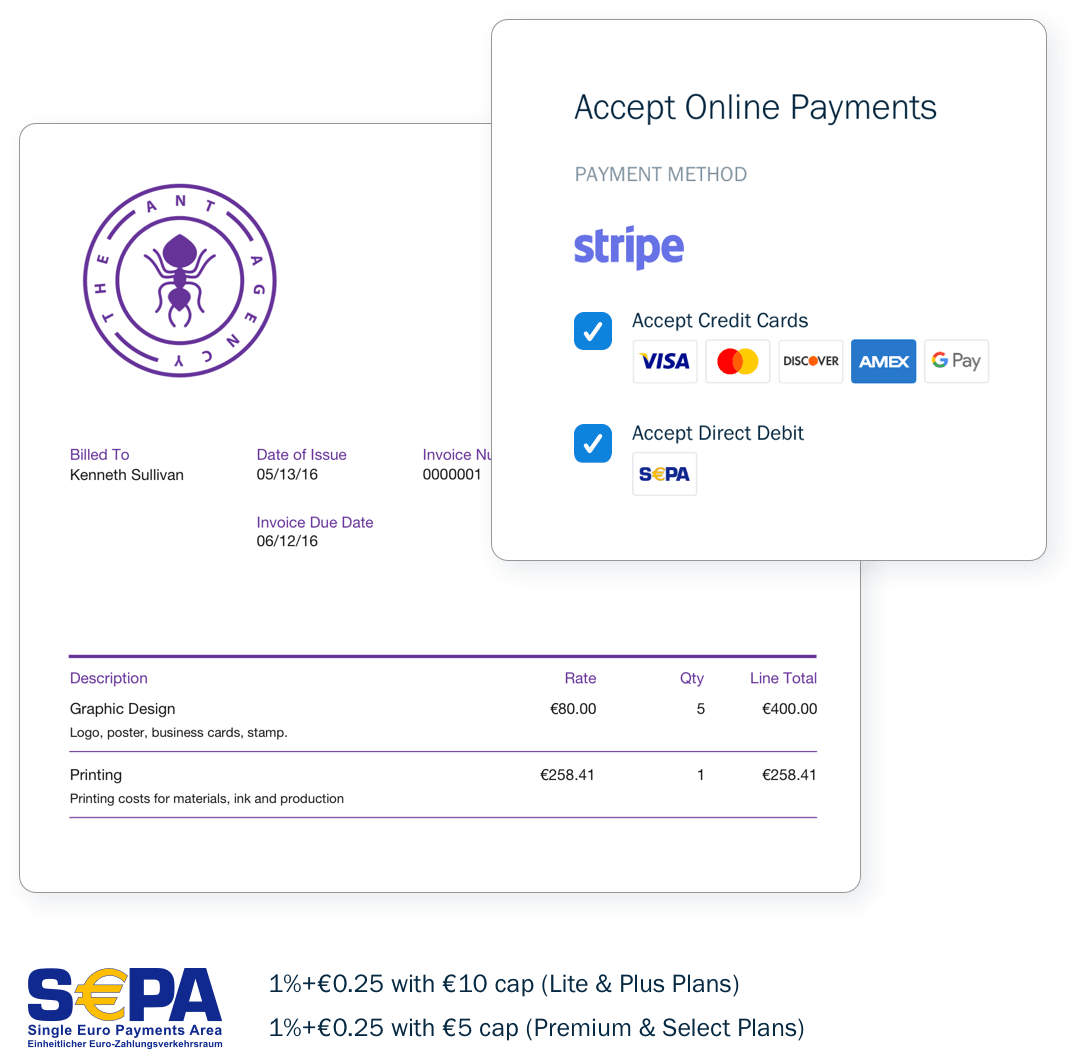

Direct Debit, Convenience for You and Your Clients

Enable SEPA direct debit payments to provide better service to your clients and improve your cash flow. Here’s how:

- A fast and easy way for your clients to pay (payment right on invoices)

- Store Direct Debit info for clients to automatically collect payments — an easy way to predict cash flow

- Low fees leave more money in your pockets (auto-added to your account as expenses)

- Automated invoice reconciliation helps avoid time-consuming, error-prone manual processes

- Recurring Direct Debit Payments allow for subscription-based billing

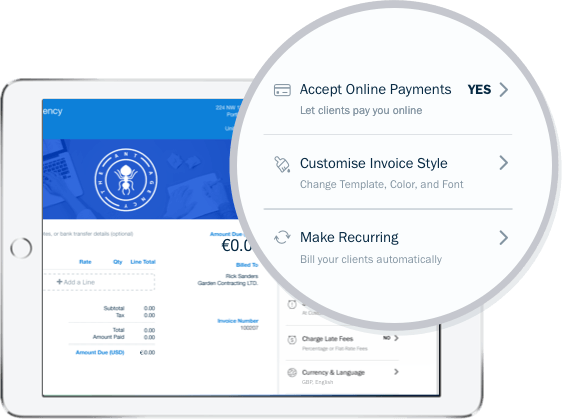

Set Up Online Payments in a Single Click

Accept credit card payments right on your invoices. Then FreshBooks deposits your money into the right account. Fast and easy payments, just like you’d expect.

Checkout Links: Accept Payments…Faster

Post Checkout Links on your website, social, or anywhere else online to simply let customers click and pay.

- Skip creating and sending invoices

- Accept credit cards and bank transfers

- Automated receipts are sent to customers

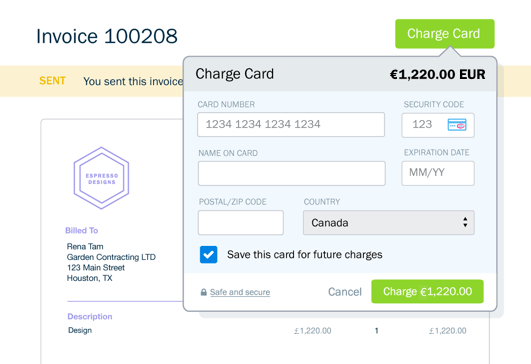

Advanced Payments: A Better Virtual Terminal

FreshBooks Advanced Payments lets you accept credit card payments online, in-person, and over the phone. Here’s why business payments are a breeze for your clients:

- Save credit card info for easy billing later

- Setup recurring billing profiles for specific clients

- Add automation and create subscription-based client profiles

Robust Payment Features to Boot

Easy payments from your clients are just a click away with these features:

- Offer clients flexibility with Payment Schedules and Partial Payments

- Request deposits to control your cash flow

- Accept international currencies with Stripe

- Auto-generated Payments Collected Reports

- Fast and easy bank deposits

- Payment options include VISA, MasterCard, AMEX, Apple Pay

- Processing fees are automatically imported as expenses

Did You Know…

Frequently Asked Questions

You can choose between Stripe & PayPal for your payment processor. Credit Card and Direct Debit options are available for SEPA.

To enable any of these payment processing options, you need to click “Accept Online Payments” in your account settings. From there, you’ll be asked to complete the steps to connect your payment processing account to the FreshBooks online payment solution. Once you’re set up, you can accept credit card payments and bank transfer payments from your clients.

Want to know why online payments are so important? Read this article Accepting Online Payments Will Help You Scale Faster, Smarter

Recurring Payments allows you to automatically charge a client’s credit card or bank transfer details on a regular basis through a Recurring Invoice. Payment is taken automatically, making Recurring Payments ideal for subscriptions or other recurring services.

To enable Recurring Payments, you need to choose a payment processor to accept credit card payments with. Next, set up a Recurring Template or Retainer, enable an online payment option, and then send the Recurring Template or Retainer to your client.

Detailed steps are available here.

More details are available here.

Want to know how to get paid faster from your clients? Read this article: Are You Practicing These 5 Key Steps to Get Faster Payments from Your Clients?

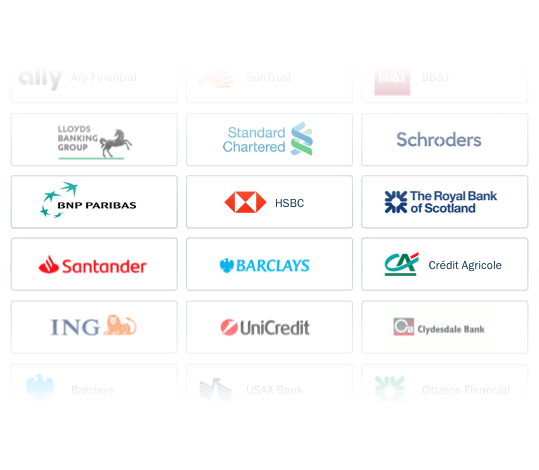

In Ireland, there are a number of payment options you can choose to accept through the FreshBooks online payment solution. FreshBooks integrates with a number of payment processors so you can choose the payments platform that works best for you and your business. Whether you want to accept credit card payments, connect your bank account, or get paid through FreshBooks Payments, you can easily set up the method you prefer for easy payments no matter what. You can also set up different payment methods for different clients, depending on what suits them best.

Here are the payment methods available to you:

- Major credit cards

- Direct Debit transfers through SEPA

- Apple Pay

- Google Pay

- PayPal

- FreshBooks Payments

- Stripe

Want to know how accepting online payments can help your business? Read this article: Marc Made Over 100k the Year After Switching to FreshBooks

FreshBooks employs industry-best online payment security practices through PCI (Payment Card Industry) compliance. This is the security standard for organisations in Ireland and worldwide that handle payments online and credit card transactions online. The PCI Standard is mandated by credit card companies and administered by the Payment Card Industry Security Standards Council. Both of our payments processors (Stripe and PayPal) employ strict PCI compliance.

The FreshBooks Advanced Payments feature is what makes all of these super safe transactions possible. Read this article to learn all about it: Get Paid on Your Terms with Advanced Payments

This depends on your payment processor and payment method. Detailed breakdowns by online payment gateway or payment system are linked below:

Want all the details on how long FreshBooks takes to process business payments? Find it in this article about payment processing.

Check out FreshBooks Select for a custom plan to save you even more.

See how FreshBooks helps you seamlessly collaborate with your team and gives you a clear picture of how your business is doing, or learn more about FreshBooks.